State of Housing #11 • 928 Words

Editor’s note:

This is the eleventh edition of our “State of Housing” series, which breaks down the HB854 Statewide Housing Study released this January. You can find previous posts in this series here.

The Commonwealth’s homebuyer assistance, housing counseling, and home renovation programs help ensure that Virginia is for Homeowners.

The fourth part of the HB854 Statewide Housing Study includes six chapters analyzing data on existing housing programs, including substantial feedback from housers across the Commonwealth that utilize these programs. Between Virginia Housing and the Department of Housing and Community Development, there are a multitude of programs that address housing needs in many different ways.

In this edition, we’ll focus on Virginia’s homeownership, housing counseling, and rehabilitation and accessibility programs. These programs were created to help Virginians access homeownership and to remain in safe and adaptable housing. Once again, there is a lot to digest within these chapters, so we’ll focus on a few key program successes and recommendations.

As a reminder, each recommendation provides an explanation of why it is needed, as well as identifying those responsible for implementing it. We go further by also providing information on how the recommendations can be accomplished.

Virginia Housing’s loan programs have increasingly served buyers of color.

Virginia Housing offers several different loan options that support first-time homebuyers, as well as down payment assistance grants and the opportunity to take advantage of Mortgage Credit Certificates (MCC).

Private activity bond demand for rental and economic development, as well as the interest rate environment, have placed significant pressures on the private activity bond allocations. These recent economic trends are resulting in the suspension of Virginia Housing’s MCC program as of April 28, 2023.

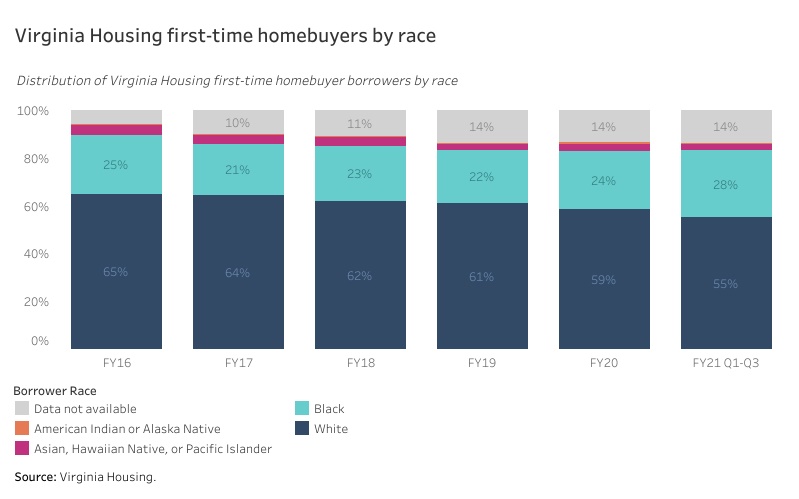

With these resources, the share of first-time buyers of color supported by Virginia Housing had increased to 31% by the third quarter of 2021, a three percentage point increase in five years. The share of Black borrowers alone accounted for the growth, going from 25% to 28% in this time period.

With the rise in interest rates, accessing homeownership is made that much more difficult for many low- and moderate-income households. Programs like Virginia Housing’s Sponsoring Partnerships and Revitalizing Communities (SPARC) have been leveraged even before the rate hikes to reduce mortgage interest rates by one percentage point to eligible first-time homebuyers utilizing their own Resources Enabling Affordable Community Housing (REACH) funds. But the demand for programs like SPARC will undoubtedly continue to rise with interest rates, placing pressure on already far-stretched resources.

Why this matters: The homeownership frenzy of the pandemic has slowed significantly due to the rise in interest rates, but home prices continue to rise—especially in places like the Richmond region. With rising interest rates, low supply, and steep competition, resources for first-time homebuyers are needed now more than ever.

Resources to increase the supply of affordable homes for sale are limited.

Many homeownership programs in Virginia are focused on educating potential homebuyers or providing resources to access homeownership (e.g. down payment assistance or affordable home loan products). These programs are focused on the demand side, but few resources exist that help increase the supply of affordable homes for sale.

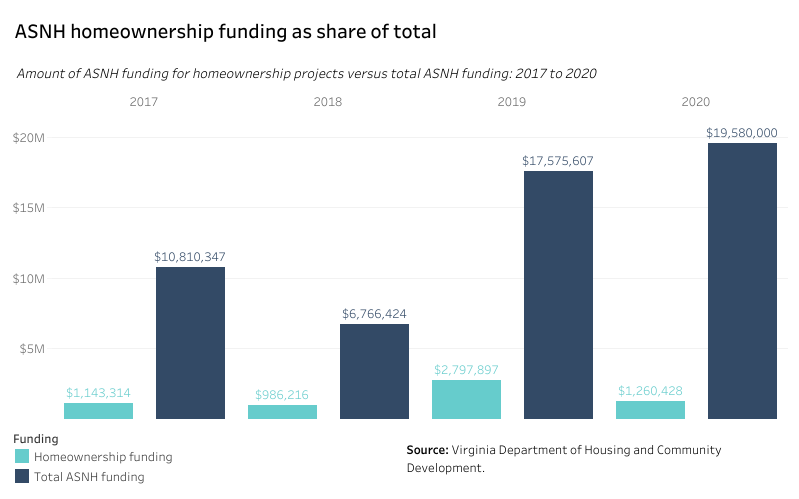

The Affordable and Special Needs Housing program operated by DHCD is the one state-level resource that provides funding to create affordable homeownership opportunities. It was not until 2017 that ASNH began awarding funding to homeownership projects and since then, homeownership projects have only made up a small portion of total ASNH funding awards.

In order to not compete with rental projects, the HB854 study recommended that DHCD create a separate application, scoring template, and funding pool for homeownership proposals within the ASNH program. Although homeownership does not yet have its own separate pool, DHCD now takes into account the differing returns between homeownership and rental when evaluating applications.

One of the most significant recommendations out of this section to address the supply-side issues was to develop a substantial, statewide starter home initiative with a capital subsidy to reduce home prices. Such a program could help create hundreds of smaller-sized homes that are no longer coming to market due to high land and construction costs, as well as regulatory barriers at the local level.

Why this matters: Rental developments are better able to leverage funding to create more housing for more people. Public funding is understandably geared towards rental, but there is a severe gap in the amount of affordable homeownership opportunities across Virginia.

Housing quality issues still plague many homeowners in Virginia.

There are numerous programs within DHCD that address housing rehabilitation and repair for low-income residents, including Indoor Plumbing Rehabilitation (IPR), the Emergency Home and Accessibility Repair Program (EHARP), and the Weatherization Assistance Program (WAP).

These programs have been leveraged—sometimes together—to help thousands of Virginians stay in safe and sanitary housing each year. But the biggest challenges in these programs have been limited and inflexible funding, as well as a declining pool of qualified contractors to carry out the work.

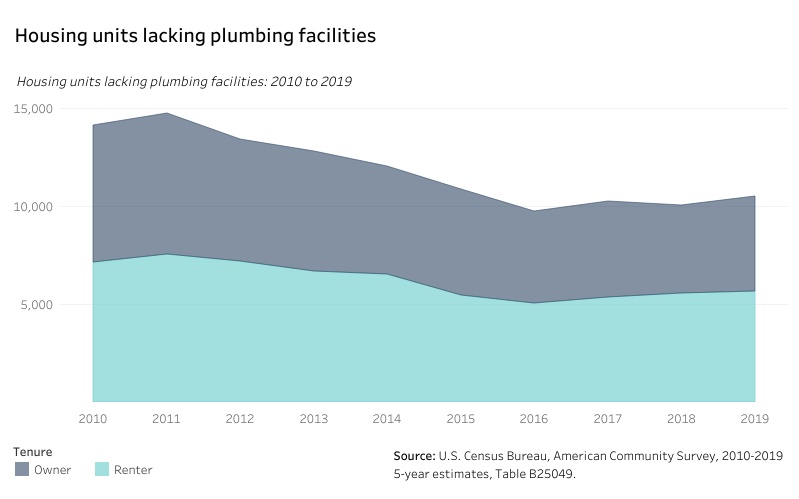

In spite of the resources available, there are still homes throughout Virginia that are in dire need of repair or rehabilitation. In 2019, there were still over 10,000 homes in the state without plumbing facilities.

To help address these persistent issues, the study recommended expansion and promotion of workforce training programs across the state, as well as looking at ways programs can help support administrative costs.

Why this matters: The labor shortage within the construction industry is hitting households in need the most. By supporting job creation programs in the trades and supporting nonprofit organization staffing and administration time, we can ensure that Virginians have a safe place to call home.

Coming up next time…

In the next edition of this series, we’ll begin exploring the HB854 study’s analysis of Virginia’s homelessness assistance and prevention programs.