The FWD #B06 • 592 Words

This basic building block of affordable housing programs isn’t always basic to explain.

Among affordable housing jargon and acronyms, Area Median Income (AMI) might be our most pervasive. After using it for years within our own industry, we sometimes forget that others may not know what it means. Hopefully this quick primer can provide you with some key tools to help explain it to your friends and colleagues.

What is AMI?

In simple terms, AMI is the median family income in a given region. It’s the median because the value is chosen after arranging all families in order of their income amounts and finding which one is exactly in the middle.

Medians are used instead of means (sum of values divided by number of records) to define AMI because they are more resistant to outliers. Means can be significantly influenced by a few very high or low earning families. This skewing can make it seem like the typical family makes much more (or less) money than they do in reality.

Note that AMI is technically different from the median household income, which is often used in our research, because a family consists of two or more people related by birth, marriage or adoption, while a household includes all individuals living under one roof regardless of relation—including individuals living alone.

Who came up with it?

The U.S. Department of Housing and Urban Development needs AMIs to set income limits that determine eligibility for HUD’s assisted housing programs, such as Section 8 Housing Choice Vouchers, as well as the Low-Income Housing Tax Credit program. State and local governments also depend on these income limits to set program eligibility for their housing programs.

This ShelterForce article offers a more detailed history of AMI, tracing its origins all the way back to federal policy in 1937!

The law requires HUD to set these income limits every year. Here is HUD’s methodology (PDF) and full list of income limits for Fiscal Year (FY) 2022. AMI limits for all parts of Virginia from 2017 to 2022 are also available as a new Sourcebook dashboard. Take a look!

What do 80, 50, and 30 percent of AMI mean?

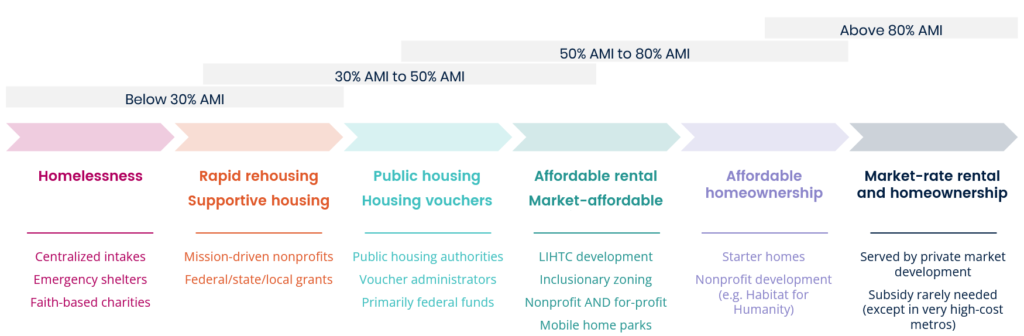

Because a region’s AMI is just a baseline, understanding the full spectrum of housing needs requires some additional math. This is where the percentages come into play. Individuals and families who make only a fraction of the AMI are considered either low-income (80 percent of AMI), very low-income (50 percent), or extremely low-income (30 percent).

These income limits help inform housing needs and the appropriate response to those challenges. Below is an over-simplified chart demonstrating how different housing solutions might apply to different AMI levels.

Federal regulations also require HUD to develop income limits that are also adjusted based on household size. Once again, we need to do some math. HUD considers a 4-person household the “baseline” and uses standard adjustment ratios to decrease or increase incomes levels for smaller and larger households, respectively.

Does HUD need to change its AMI methodology?

The most common criticism about AMI is the potential influence of high-income suburbs within a region. Wouldn’t this over-inflate AMI values and make it harder for lower-income households in a city to access housing programs? In theory, this sounds like a reasonable concern.

However, as the NYU Furman Center explains, the methods aren’t the problem. In fact, HUD even adjusts for “High Housing Cost Areas.” To better serve the lowest incomes, local policymakers can design or amend programs to meet the deepest needs. While this usually requires additional subsidy, or leads to fewer households being served, extra math won’t be necessary.

What programs, policies, and issues do you find most challenging to explain to policymakers? Let us know, and your suggestions may show up in a future edition of Back to Basics.