The FWD #183 • 563 Words

The story of Millennials and homeownership continues its ups and downs.

There has perhaps been no demographics and housing topic written about more in the past decade than the issue of when, why, and how Millennials are entering homeownership. But recently, fresh data from last year has cast new light on this roller coaster story. And, since Millennials represent the largest demographic group in the nation (eclipsing boomers over the last few years), they are now the main drivers of demand in the U.S. housing market. So, it is with some trepidation that we venture into the subject again.

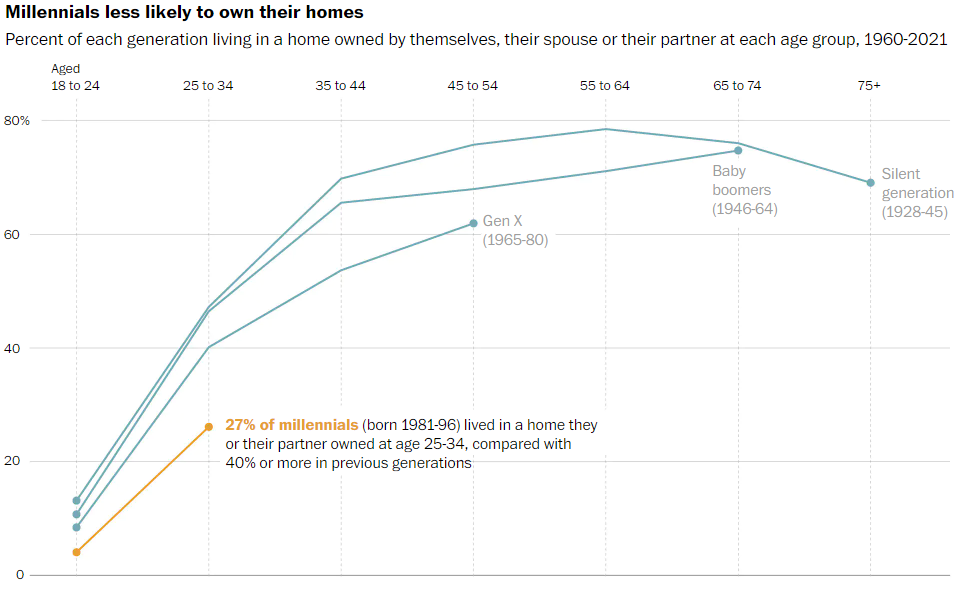

The Millennial homeownership story emerged shortly after 2010 when their cohort began to reach their 30s—traditionally the time when homeownership becomes the dominant form of housing tenure. However, the script for Millennials was different. Coming out of the mortgage and foreclosure crisis of 2008-2012, more households in their 30s remained renters than the previous generation. Millennials began to lag behind historical trends.

The many reasons for this have been analyzed and re-analyzed. The housing-driven “Great Recession” that followed clearly impacted the economic status of Millennials. High unemployment and low wage growth was a barrier to savings. Millennials were more likely to stay in school and stay at home with parents. This delayed marriage, household formation, and parenting more than earlier generations.

To make things worse, this generation was the first to be burdened with crushing student debt. These trends were compounded by the movement of Millennials from low-housing cost areas to urban centers where affordability was more challenging. In low-cost markets like Detroit, Millennials are at 75% of the overall homeownership rate, whereas in San Diego it’s just over a third.

A final compounding factor is that this generation is more diverse than previous ones, so the historically lower rates of homeownership in the U.S. for households of color have a greater impact for this demographic group than for Baby Boomers or Gen X-ers. Closing the racial equity gap in homeownership is an important aspect of enabling Millennials to catch up to previous generations.

As a result, by the late 2010s, many analysts assumed Millennials would be a renter generation permanently.

Then, as with all good stories, there was a twist. During—and in spite of—the pandemic, Millennials began a love affair with homeownership. From 2019 through 2021, this age group became homeowners faster than ever before.

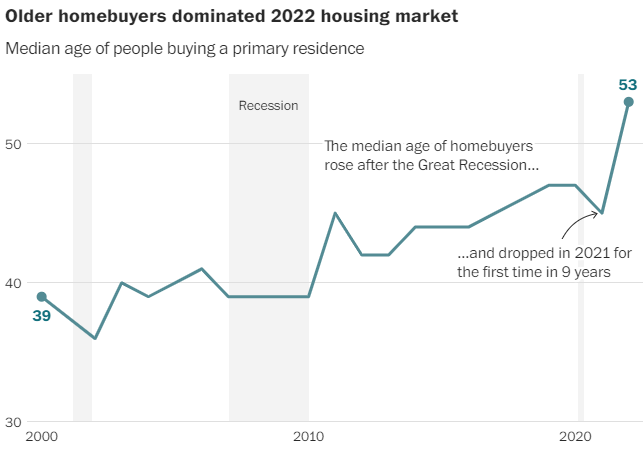

Record low interest rates and better housing supply fueled the shift. It seemed that there was finally a reversion to the mean—toddlers and white picket fences would surely supplant amenity-rich apartments in urban centers. The median age of US homebuyers dropped in 2021 after almost a decade of increases. Millennials were more than half of all Freddie Mac loans in 2019.

But just when the story seemed headed to “happy” conclusion, Lucy pulled the football away once again. In 2022, spiking mortgage rates and relentlessly rising home prices shut younger buyers out and the national average homeowner age climbed to an all-time high of 53.

Many analysts still assume that Millennials will eventually catch up to Gen X and Boomers, but the picture is not clear. In 2018, 13% of Millennials said they would “always” rent, and by 2022 that number had climbed to 25%. Stay tuned—the end of this story hasn’t been written. Rest assured, we’ll keep checking in on it from time to time.