The FWD #172 • 629 Words

Rising rates, rising rents: A riddle for the ages.

We all know what happens in the single-family market when interest rates rise: homebuyers can afford less, which puts downward pressure on pricing. Some homebuilders even slow down construction of new homes thanks to that decrease in homebuyer purchase power.

So what about multifamily?

In some ways, multifamily housing stock “benefits” from the strain on single-family markets—potential homeowners are more likely to continue renting instead. This is part of why we will likely see continued rent increases for the foreseeable future.

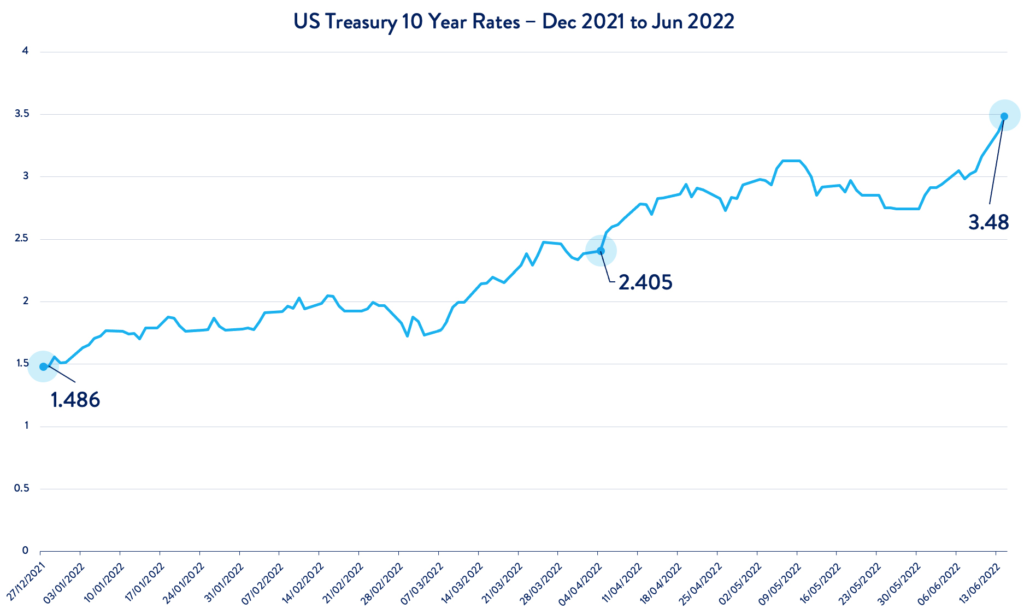

And so, as rental demand remains strong and rents increase, multifamily buildings should be valued very highly. But don’t forget why we’re here in the first place. Rising interest rates affect the purchase and sale of these buildings, too.

Investors and owners who buy and sell multifamily buildings have seen prices drop thanks to rising rates. Commercial property owners are seeing a similar increase in their cost to borrow.

A July survey of multifamily buyers from the National Multifamily Housing Council found that costs for both the debt and equity necessary to finance property acquisitions had already increased, putting sales volume on a downward trend.

Even with fewer sales, respondents still noted that property sellers have not yet panicked enough to dramatically slash prices—although Green Street, a market data firm, found that apartment prices fell 4 percent from May to June.

Why are multifamily sellers not lowering prices if demand is lower?

Sellers likely believe the current economic conditions are short-lived. They are betting on the “fundamentals” they see in the market: increased consumer demand for rental housing, primarily driven by the lack of housing supply for both rental and homeownership.

This lack of supply doesn’t show signs of improving any time soon, which means multifamily rents can continue to rise and generate increased income for their owners. Property sellers likely believe interest rates will stabilize in the near term. If they stop believing that, we could not only see lowered sales volume, but also lower trading prices for apartments.

According to CoStar, the sales volume of apartment buildings was $5.3 billion in the last quarter of 2021—smashing the previous high-water mark of $3 billion a year prior. Sales dipped significantly in the first quarter of 2022, but reached over $2.8 billion in the second quarter.

For now, the multifamily housing market remains strong.

“We still have hundreds of billions of dollars of undeployed capital still allocated to multifamily that wants to be allocated to multifamily,” David Brickman, the former CEO of Freddie Mac and the current CEO of NewPoint Real Estate Capital, told GlobeSt.com.

In other words, the market will probably overcome these new interest rate pressures. Commercial properties might change hands between investors less often, but thus far it’s done nothing to quelch the increase in rents.

The average per-unit sales price of an apartment in Virginia now exceeds $259,000. That’s more than 10 percent more than this time last year. The average home sales price in Virginia was about that just 5 years ago!

Renters increasingly need relief from rising rents, especially after the expiration of pandemic rent relief. Legislators are taking notice: last month, a companion bill to the U.S. Senate’s Eviction Crisis Act was introduced in the House of Representatives. The bipartisan Stable Families Act would create a permanent rent relief program in the form of a federal Emergency Assistance Fund for households struggling to pay rent, funded at $3 billion per year.

Could that be enough? Only time—and Congress, and the market—will tell.