Photo: Eggleston Plaza in Richmond, a smaller 4% bond urban infill project. Source: VCDC.

The FWD #B10 • 1,220 Words

Editor’s Note: This post draws heavily on HousingForward Virginia’s HB854 Statewide Housing Study from 2022. click here to see the full report.

Bond financing is an important part of funding affordable housing in Virginia.

But it is also one of the least understood. In this edition of Back to Basics, we’ll start to give you a brief primer on the ways Virginia uses bonds to help create new affordable rental and homeownership opportunities. There’s more to it than you might think!

What exactly is a bond?

A bond is basically a loan. The issuer offers the bond to investors (the “lenders”) who are promised a fixed rate of interest for a fixed period of time. The issuer then uses these funds for a specific purpose and repays the investors interest and principal afterward.

The credit worthiness of the issuer, the use of the funds, reserves, and the source of repayment all factor into the “rating” of the bond. Bonds with higher ratings benefit from lower interest cost. For example, US Treasury Bonds carry the highest ratings and therefore the lowest interest cost.

Bonds may be issued by:

- Local, state and the federal government,

- Other public authorities (e.g. Virginia Housing or a local housing authority), and

- Private corporations.

Bonds can be used for almost anything, but you’ll most often see them used to fund large public goods like new parks, schools, infrastructure, or utility projects. For purposes of affordable housing, we’re usually talking about bonds issued by governments and other public authorities.

Broadly, there are three types of bonds used for housing: private activity bonds (PABs), taxable bonds, and general obligation (GO) bonds. With some exceptions, PABs and GO bonds are tax exempt, meaning the bond purchaser is exempt from paying income tax on the interest earned. Historically, this has meant that properties financed by tax-exempt bonds carry a lower interest. However, in the last decade, the gap between taxable and tax-exempt bonds has narrowed.

Private activity bonds

Private activity bonds (PABs) are issued by state and local authorities. As the name implies, they are used to finance “private” (not public, e.g. roads and bridges) activities. Housing is the largest user of these bonds, but they can also be used for various “economic development” activities, such as industrial parks. These bonds are tax exempt.

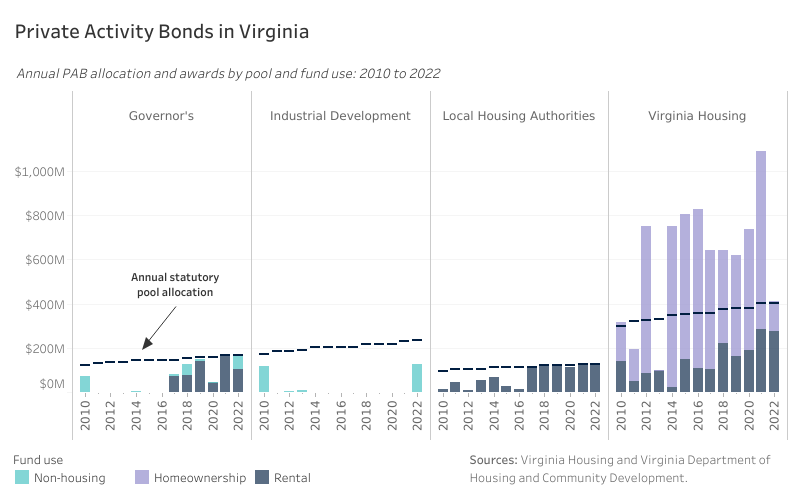

The aggregate amount of these bonds that can be issued each year is set by Congress. Allocations to each state are then determined by the IRS using a population-based formula. In 2023, Virginia’s total PAB allocation is $1.04 billion. This amount has increased 2 to 3% percent annually on average over the past decade.Each year the total allocation is divided into four pools, which are managed by DHCD. Virginia state law sets the amount allocated to each pool:

| Pool | Amount for 2023 | Use |

|---|---|---|

| Virginia Housing | 43% | Affordable rental and homeownership |

| Industrial Development | 25% | Manufacturing and other exempt projects |

| Governor’s (state allocation) | 18% | Housing, manufacturing facilities, and other exempt projects |

| Local Housing Authorities | 14% | Affordable rental |

Here are the primary ways Virginia uses its PABs for affordable housing.

Multifamily “4%” bonds

Virginia Housing and public housing authorities issue tax exempt bonds for multifamily projects. These bonds also carry with them an allocation of “4%” Low-Income Housing Tax Credits (LIHTCs). The 4% credits are less than half the value of the competitive 9% LIHTCs that Virginia Housing allocates annually, but in the last decade, they have funded a significant share of all affordable rental housing produced in Virginia.

While bond projects used to be confined to large scale developments in the highest rent markets, lower interest costs, wider availability of gap financing, and increasing rents overall have made smaller projects more feasible in many markets across the state. One of the attractive features of these credits is that, unlike 9% credits, they are not competitive. These bonds contribute to the total PAB cap for the state.

Under IRS rules, at least 20% of the apartments in these multifamily developments must serve households at 50% AMI, or 40% of units must serve households at 60% AMI. This is the reason these bonds are sometimes known as either “80/20” or “60/40.”

While mixed-income is permitted, the most common application of multifamily bonds is where 100% of units serve households at 60% AMI or less in order to maximize the equity from the Low-Income Housing Tax Credits attached to the affordable units. Truly mixed-income multifamily projects that include market rate and tax credit units in the same building are rare.

In 2020, just over $300 million in such bonds were issued in Virginia, about two thirds by Virginia Housing and one third by local housing authorities.

Single-family Mortgage Revenue Bonds and Mortgage Credit Certificates

Mortgage Revenue Bonds (MRBs) finance mortgages to low- and moderate-income households for the purchase of new or existing homes. They are included in the state bond cap. Following the foreclosure crisis, the IRS allowed the substitution of Mortgage Credit Certificates (MCCs) in place of MRBs due to disruptions in the bond market. Virginia Housing has used MCCs since 2015 and has not issued MRBs since that time.

These provide a dollar-for-dollar credit against the homeowner’s tax liability. The credit amount is 10% of the homebuyer’s annual mortgage interest.

MCCs are used in conjunction with Virginia Housing mortgage loans as well as non-VH loans. MCCs are available only to income-eligible households, and the sales price must fall under the program limit. The program targets first-time homebuyers or those who have not owned a home in the previous three years. In fiscal year 2020, 6,841 buyers received MCCs—up from 892 in fiscal year 2016.

However, in February, Virginia Housing announced that the seven-year run of MCCs would be coming to an end. The demand for bond financing for rental housing has now grown so quickly that the state bond cap will be fully utilized with housing bond issuance. Such bonds have the added benefit (as noted earlier) of carrying the 4% tax credit with them. With rising mortgage interest rates, Virginia Housing may also consider using mortgage revenue bonds (MRBs) once again.

State bond cap allocation trends

PABs serve a variety of purposes in different states. The majority of PABs in Virginia are used for housing. Recent analysis from Novogradac shows that Virginia consistently has been among the top ten states for total PAB volume dedicated to multifamily housing. In fact, from 2014 through 2021, no less than 94% of Virginia’s annual PAB allocation went to affordable rental or homeownership programs.

Last year, however, changed that trend. As demand for mortgages declined, Virginia Housing used only 16% of the total allocation for MCCs. Another 62% went to rental efforts via Virginia Housing and local housing authorities, and the remainder (about 23%) went to economic and industrial development. This was the largest amount dedicated to non-housing uses since 2010.

Taxable bonds

State-level taxable bonds are uncapped and primarily used by Virginia Housing for the construction and acquisition of affordable multifamily housing. Both nonprofit and for-profit developers may use this financing. Many 9% competitive LIHTC projects use taxable bond financing to help create apartments affordable to low- and moderate-income renters. You can learn more about these bonds on the Virginia Housing website here.

We’re not done yet!

Didn’t get your fill of bonds in this blog? You’re in luck. In the next Back to Basics, we’ll cover the ways localities can use municipal GO bonds for affordable housing. Stay tuned.